Saudi Arabia has a three-in-one currency system, that is, gold coins manufactured by the U.S. Mint in Philadelphia in 1945 and 1947 are used as Saudi Arabia's national currency, while pound, the British standard measure of weight, is taken as the unit of the gold coins.

The issuance of currency in any country is more or less related to war, as the victory or defeat in a war would bring about fiscal inflation or collapse. In order to settle debts and provide funds, the treasury must reform and issue new currencies. Therefore, it is a must to understand the historical background of oil, gold and the US dollar which are inextricably linked before and after the Second World War to interpret the two gold discs (as shown in the pictures).

II The Bretton Woods System

The issuance of currency in any country is more or less related to war, as the victory or defeat in a war would bring about fiscal inflation or collapse. In order to settle debts and provide funds, the treasury must reform and issue new currencies. Therefore, it is a must to understand the historical background of oil, gold and the US dollar which are inextricably linked before and after the Second World War to interpret the two gold discs (as shown in the pictures).

I Oil Companies in Saudi Arabia

In 1901, King Saud bin Abdul Aziz, the founder of Saudi Arabia, maintained good relations with the British government because Britain had helped Saudi Arabia gain independence from the Ottoman Turkish Empire. After the unification of Saudi Arabia on September 28, 1928, Britain was the first country to recognize it as an independent state. As a result of the protection and institutional influence by the UK over the years, the Saudi Arabia's currency adopted the British pound as the unit. In May 1931, the United States also fully and officially recognized the government of Saudi Arabia. In 1933, King Saud bin Abdul Aziz granted an oil concession to Standard Oil of California (Socal, later known as Chevron) for technical and financial assistance. Socal incorporated the California Arabian Standard Oil Company (Casoc) for this purpose. In 1936, Texas Oil Company (later Texaco) also joined Socal, acquiring a 50% ownership stake in Casoc. They were allowed to explore for oil in Has-Hasa, an eastern province of Saudi Arabia. Casoc offered the Saudi Arabian government £35,000 and a further £20,000 after 18 months. In addition, if oil was found in Has-Hasa, a lease fee of four gold shillings would be paid to the Saudi Arabia government for every ton of crude oil produced. Saudi Arabia also received a share of oil sales, as well as various rent and license payments. In 1938, high-quality crude oil field was found at Dammam Dome near present-day Dhahran, another eastern province of Saudi Arabia, which kicked off a major development of the oil industry in Saudi Arabia.

After World War II, the reconstruction and economic revival of Western European countries led to a surge in demand for oil. In December 1948, the American holding company Casoc decided to introduce Standard Oil of New Jersey and Standard Oil of New York as shareholders of the company in order to obtain more funds to restart and develop the oil exploitation in Saudi Arabia. The company's shares came to be held by four U.S. oil giants, namely Chevron (30%), Texaco (30%), Exxon (30%) and Mobil (10%), and the company was renamed as Arabian American Oil Company (Aramco).

From 1944 to 1949, Aramco supplied oil to the U.S. military, and its strategic and political importance skyrocketed.

It was because of World War II that the importance of oil as a strategic material was demonstrated. Hitler's defeat was partly due to Germany's shortage of oil. The U.S. government was tilting toward Saudi Arabia and Aramco in order to obtain adequate oil supplies from the Middle East. Aramco was given a once-in-a-lifetime opportunity to grow, and crude oil supplies increased 25-fold from 20,000 barrels per day (bpd) in 1944 to 500,000 barrels per day in 1949. The Ras Tanura refinery's processing capacity was increased from 50,000 to 127,000 bpd, primarily to supply the growing demand from the U.S. Navy. In 1947, Aramco could produce as much as 200,000 barrels per day. The Saudi royal family also became rich overnight, and in 1946 alone the king earned about $15 million from Aramco.

Therefore, Aramco had to pay the Saudi government every year for the franchise in 1944-1947, and the 55,000 pounds and other rental operating expenses for exploration, marketing and refining. Then, is the fact that the fee was required to be paid with gold coins instead of US dollars related to the high increase in the price of gold led by the US-Japan Pacific War after World War II?

After World War II, the reconstruction and economic revival of Western European countries led to a surge in demand for oil. In December 1948, the American holding company Casoc decided to introduce Standard Oil of New Jersey and Standard Oil of New York as shareholders of the company in order to obtain more funds to restart and develop the oil exploitation in Saudi Arabia. The company's shares came to be held by four U.S. oil giants, namely Chevron (30%), Texaco (30%), Exxon (30%) and Mobil (10%), and the company was renamed as Arabian American Oil Company (Aramco).

From 1944 to 1949, Aramco supplied oil to the U.S. military, and its strategic and political importance skyrocketed.

It was because of World War II that the importance of oil as a strategic material was demonstrated. Hitler's defeat was partly due to Germany's shortage of oil. The U.S. government was tilting toward Saudi Arabia and Aramco in order to obtain adequate oil supplies from the Middle East. Aramco was given a once-in-a-lifetime opportunity to grow, and crude oil supplies increased 25-fold from 20,000 barrels per day (bpd) in 1944 to 500,000 barrels per day in 1949. The Ras Tanura refinery's processing capacity was increased from 50,000 to 127,000 bpd, primarily to supply the growing demand from the U.S. Navy. In 1947, Aramco could produce as much as 200,000 barrels per day. The Saudi royal family also became rich overnight, and in 1946 alone the king earned about $15 million from Aramco.

Therefore, Aramco had to pay the Saudi government every year for the franchise in 1944-1947, and the 55,000 pounds and other rental operating expenses for exploration, marketing and refining. Then, is the fact that the fee was required to be paid with gold coins instead of US dollars related to the high increase in the price of gold led by the US-Japan Pacific War after World War II?

II The Bretton Woods System

After the Second World War, in July 1944, President Roosevelt promoted the establishment of three world systems: a political system - the United Nations; a trade system - the General Agreement on Tariffs and Trade, later known as the WTO; and a monetary and financial system, the Bretton Woods System. The Bretton Woods System was a gold exchange standard system based on the dollar and gold, also known as the dollar-gold standard system. It made the dollar the center of the post-war international monetary system. The dollar had become the equivalent of gold as the world currency, and the United States assumed the obligation to exchange dollars with gold at an official price, which meant other currencies could only have relations with gold through the U.S. dollar. Since then, the U.S. dollar has been the means of payment for international clearing and the main reserve currency of all countries. Statistics show that at the end of the Second World War, the U.S. government held about 70% of the world's gold reserves. The Bretton Woods System established the rules, the measures, and the corresponding forms of organization on such issues as the exchange of currencies, the regulation of the balance of payments, and the composition of international reserve assets, as a sum of agreements.

Between 1944 and 1973, most countries joined this monetary system with the U.S. dollar as the center of international currency. At first, the dollar was pegged to gold. Countries confirmed that the official price of gold was $35 per ounce as set by the United States in January 1944, and the gold content of each dollar is 0.888671 grams of gold. Governments or central banks could exchange gold with the United States in U.S. dollars at official prices. In order to keep the official price of gold from being hit by the Libreville Field gold price, governments needed to work with the U.S. government to maintain this official price of gold in the international financial markets. Second, the currencies of other countries were pegged to the U.S. dollar, and other governments set the gold content of their respective currencies and determined the exchange rate with the U.S. dollar through the ratio of the gold content. Before 1944, the import and export of gold was completely free under the international gold standard, but under the Bretton Woods System, the flow of gold was subject to certain restrictions. Before the Second World War, the United Kingdom, the United States and France allowed residents to exchange gold; other countries implementing the gold exchange standard also allowed residents to use foreign exchange (pounds, francs or dollars) to exchange gold with the United Kingdom, the United States and France; after the Second World War, the United States only agreed to let foreign governments to exchange gold with the dollar with the United States in certain conditions, while it did not allow foreign residents or companies to exchange gold and dollars.

After the US-Japan Pacific War (1941-1945), the price of gold was high, while the official price of 1 ounce of gold under the Bretton Woods System was limited to $35. In addition, gold could not be bought or sold by private companies. If Aramco paid Saudi Arabia in U.S. dollars, then in times of high gold prices, it would be detrimental to the Saudi Arabia government. Therefore, Saudi Arabia might be compelled to ask the U.S. Philadelphia Mint to mint gold discs (non-legal gold coins) for it in the name of the state, but it privately paid the U.S. government through Aramco. Then, the United States mints gold discs for the Saudi Arabia in the name of the government to comply with Bretton Woods regulations.

If the Saudi Arabia government followed the trend of the times with its adequate oil resources, it could have used a flexible approach by taking full use of its advantage of oil, pay attention to balance the special relationship between Saudi Arabia and the United States, and ensure that the United States could tolerant the oil problem, so as to achieve their own interests of oil. In terms of time, is it possible for the Aramco to promote Saudi Arabia's request to the United States to mint gold coins as large tokens after World War II?

There were two sizes of gold discs minted by the United States for Saudi Arabia.

1. Large Gold Discs

Four-pound gold disc (Figure 1).

Fig. 1 Obverse inscription: U.S. MINT. PHILADELPHIA-U.S.A. The center of the discs is a bald eagle designed by Charles Thomson (1729-1824), representing the capable and intelligent elite, surrounded by words "United States Mint - Philadelphia - USA". The eagle centered in the inner tooth-edge circle of the obverse features the leftward face, spreading wings, and talons grasping an olive leaf (representing peace) on the left and a trapped arrow (representing the pledge of strength) on the right, with 13 horizontal stripes on its chest, representing the 13 states that joined the United States in 1777.

The reverse features a rectangular pattern with three lines of words [GROSS WEIGHT-493.1 GRAINS. -- NET WEIGHT-452.008333 GR-FINENESS 9162/3]. Therefore, a gold disc contains 452.00gr. or 0.942 oz. of gold, with 91.6% in purity.

Note: 493.1gr = 31.95g. The entire gold disc weights slightly over 1 oz. [1 once = 28.35g]. In 1945, a total of 91,210 pieces of large gold discs were issued, but most have been melted down.

Note: The British gold coins weigh 5 pounds, 2 pounds, 1 pound (Sovereign) and 1/2 pound. There is no 4-pound coin, which is unique. It is possible that the 4-pound coin is in line with the international popular system of one tael at that time.

2. Small Gold Discs (Figure 3)

The obverse has the same design as the 4-pound gold disc; the reverse has three lines of inscription: CONTAINS - 0.2354 TROY OZS - FINE GOLD. Its denomination is 1 pound and the gold content is 7.32g.

Note: One troy oz is a British unite which is equal to 31.10g [31.10 x 0.2354 = 7.32g]. FINE GOLD means its purity is 999.9‰.

In 1947, the Philadelphia Mint struck 121,364 small discs, the vast majority of which were melted down. The design of small discs is similar to that of small British Sovereign gold coins, with the same amount as the 1-pound British Sovereign gold coin. These small discs were actually commonly used in Saudi Arabia and traded at a value of $12, or 40 Saudi riyals of silver.

The gold standard is a monetary system in which gold is the standard currency. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold (that is, the gold content of currency); when different countries use the gold standard system, the exchange rate is decided by the gold parity of their respective currency gold content. The gold standard system became prevalent in the mid-19th century. In history, there have been three forms of the gold standard system, namely, gold exchange standard, gold bullion standard, and gold and fiat money standard. Among them, the gold fiat standard is the most typical form, and the gold standard system refers to such a monetary system in a narrow sense.

The international monetary system centered on the U.S. dollar after the Second World War is actually a gold exchange standard system. The United States does not circulate gold coins and private individuals cannot own gold coins, but allow other countries to exchange for gold discs as mentioned above with U.S. dollar in the name of government. The above 4-pound and 1-pound gold discs are financial products of this era, when the dollar was the main reserve asset of other countries. However, the system also gradually began to shake due to the impact of the dollar crisis. When it came to August 1971, the U.S. government stopped the exchange for gold with U.S. dollar, and it devalued the dollar twice. The incomplete gold exchange standard system collapsed, and the gold bullion standard system and the gold exchange standard system basically disappeared in the 1970s.

III How to Distinguish the Real from the Fake?

The 4-pound gold disc is cast with 22K gold [92% color, (22/24)] gold, and the 1-pound is equivalent to one sovereign of the United Kingdom. The gold disc is of brilliant color, excellent purity, warm feeling, and beautiful shape, being popular among the people. Yet, counterfeiting is rampant. For instance, Swiss and Lebanese counterfeiters began making similar gold discs with lower gold content.

Most of these gold discs are no longer in existence, as a large number of them were boxed up and shipped to Mumbai, India, sold for $70 per ounce, twice the official U.S. price. Many other gold discs were melted down, turned into gold bars and shipped to Macau for sale to private gold stores or the Chinese Central Mint for casting gold bullion. Afterwards, the Saudi Arabia government melted down many of the remaining gold discs, and reused them to produce its own gold coins. For example, in 1950, Saudi Arabia melted down most of the gold discs made in Philadelphia, USA, and started minting its own gold coins again. (Fig. 4)

This is because their weights are exactly the same as those of other popular gold coins of the world at the time. This, coupled with the interesting historical background, beautiful design, gold splendor and high value gold disc (DISC), made these pieces a popular target for counterfeiters.

The genuine discs feature many bumps on the obverse, almost like tiny pebbles. Fakes also show this effect, but it appears weaker, without small bumps next to the letters. Especially in the circle of characters P.D., there is no or inconspicuous small raised bumps. Also, the genuine discs have the fine lines like a spider web between each characters of M-I-N-T. If there is no such feature, it may be a fake as Figure 5.

IV Conclusion

From the 1940s to the 1950s, the U.S. government played as the backstop and protector for companies to expanding their oil sources in the Middle East, while companies were the front speakers in increasing U.S. influence over countries or regions that needed oil.

The years of political and financial chaos in the world after World War II led to the rise of gold and oil prices and the fall of the U.S. dollar. The Saudi Aramco, an American international oil company, was established for exploring oil in the Middle East. The U.S. government has provided monetary and technical assistance to the Saudi Arabia government and set up worldwide financial procedures, such as the WTO and the Bretton Woods system, to maintain the world financial system.

In mid-February 1943, the managing directors of Mobil, Texaco and Casoc visited the U.S. Secretary of State in Washington, D.C. They requested financial assistance from the U.S. government in order to keep Britain out and ensure that they would remain U.S. companies after World War II. If the United States was willing to assist, in return the Saudi royal family will give the U.S. government certain opportunities and options to participate in the oil exploitation in Saudi Arabia. Beginning in 1944, the U.S. accelerated the pace of aid to Saudi Arabia under the Lend-Lease Act, and by the end of the war, U.S. direct or indirect aid to Saudi Arabia reached $90 million, 73% of which was gifted, making the U.S. the largest aid donor to Saudi Arabia.

Is it possible that the large 4-pound gold disc was minted in 1945 by the U.S. government for financial assistance?

Note: According to the record from 1949, the United States had gold reserves of 24.6 billion U.S. dollars, accounting for more than 70% of the total gold reserves of the entire capitalist world at that time.

In 1944, Socal changed its name to Arabian American Oil Company or Aramco for short. According to Boosel's article in the ANA journal The Numismatist published in July 1959, the contract between Saudi Aramco and the Saudi Arabia government required that Saudi Aramco pay an annual franchising fee of $3 million in gold to the Saudi Arabia government. Although payments in U.S. dollars were accepted throughout World War II, at the end of the war, the Saudi Arabia government insisted that payments by gold should be restored. Was it possible to use gold discs instead for hedging purposes? Considering that British gold coins were seldom seen in circulation in the market at this time, Aramco may have signed a contract with the U.S. Treasury Department to mint gold discs, which seems logical. The Philadelphia Mint produced the 1947 small discs that were identical to the gold British sovereign, and both gold coin and gold disc contain 0.2354 ounces of gold, with a purity or fineness of 0.9167, which underscores the fact that these gold discs were a replacement for the main 1-pound British gold coin.

According to the author's estimation, if so, it is a coincidence in terms of the timing of the 4-pound large American disc. For example, the time of the high price of gold after World War II, the restrictions of the Bretton Woods Agreement in 1944, and the issuance of large discs in 1945 are coincident.

Note: Though it is named the 4-pound gold disc for convenient circulation in the world, it is also known as one-tael gold disc as it is nearly one tael.

According to the J.P. Koning's article Why the US Mint once issued gold discs to Saudi Arabia published in November 26, 2018, a reference from the Federal Reserve Economic Research Documentation System (FRASER) indicates, "... in October 1947, the US Mint received a third order from the Saudi Arabia government. But the Saudi Arabia government eventually canceled this third order based on a better offer. In December of that year, U.S. officials told the Saudi Arabia government that the Treasury was willing to auction off the old British gold sovereigns held in its official reserves. For the Saudi Arabia government, this actual auction offer was too good to give up, so they canceled the third request to cast gold discs, and purchased the gold pounds auctioned by the United States ..." It can be seen that the Saudi Arabia government had the possibility to make the first (1945 large gold disc) and the second (1947 small gold disc) orders.

In the Second World War, Saudi Arabia itself, like most countries in the Middle East, did not have its own monetary system, that is, it did not produce its own coins. For smaller transactions, the Saudi people relied mainly on foreign silver coins, including, for example, the Maria Theresa dollar, a coin minted in Austria, which was the most commonly used at the time. Second is the Indian rupee. For bigger transactions the Saudis used the British gold pound. However, around the First and Second World Wars, the British economy was weak and gold was in shortage. The Britain no longer minted British gold pounds, which would inevitably lead to a shortage of British gold pounds. Against this background, Saudi officials would go out of their way to provide the country with a viable alternative to gold for circulation within its borders.

Therefore, it is entirely reasonable for the Saudi Arabian government to seek help from the U.S. Treasury Department. At the time, the U.S. Treasury was the largest owner of gold in the world, and the U.S. Mint could mint coins. The Saudi Arabian government had originally requested the British government to supply the original dies for the British gold pounds to the U.S. Mint in Philadelphia for minting, but British officials refused to grant the U.S. Mint the original dies for the sovereign gold coins. The Philadelphia Mint offered a good second-best choice for the Saudi Arabia government in the form of simple, attractive gold discs of a size and weight similar to the British gold coin series. In addition to their widely-accepted purity, weight, and markings, they were also be part of a mainstream worldwide currency system.

Between 1944 and 1973, most countries joined this monetary system with the U.S. dollar as the center of international currency. At first, the dollar was pegged to gold. Countries confirmed that the official price of gold was $35 per ounce as set by the United States in January 1944, and the gold content of each dollar is 0.888671 grams of gold. Governments or central banks could exchange gold with the United States in U.S. dollars at official prices. In order to keep the official price of gold from being hit by the Libreville Field gold price, governments needed to work with the U.S. government to maintain this official price of gold in the international financial markets. Second, the currencies of other countries were pegged to the U.S. dollar, and other governments set the gold content of their respective currencies and determined the exchange rate with the U.S. dollar through the ratio of the gold content. Before 1944, the import and export of gold was completely free under the international gold standard, but under the Bretton Woods System, the flow of gold was subject to certain restrictions. Before the Second World War, the United Kingdom, the United States and France allowed residents to exchange gold; other countries implementing the gold exchange standard also allowed residents to use foreign exchange (pounds, francs or dollars) to exchange gold with the United Kingdom, the United States and France; after the Second World War, the United States only agreed to let foreign governments to exchange gold with the dollar with the United States in certain conditions, while it did not allow foreign residents or companies to exchange gold and dollars.

After the US-Japan Pacific War (1941-1945), the price of gold was high, while the official price of 1 ounce of gold under the Bretton Woods System was limited to $35. In addition, gold could not be bought or sold by private companies. If Aramco paid Saudi Arabia in U.S. dollars, then in times of high gold prices, it would be detrimental to the Saudi Arabia government. Therefore, Saudi Arabia might be compelled to ask the U.S. Philadelphia Mint to mint gold discs (non-legal gold coins) for it in the name of the state, but it privately paid the U.S. government through Aramco. Then, the United States mints gold discs for the Saudi Arabia in the name of the government to comply with Bretton Woods regulations.

If the Saudi Arabia government followed the trend of the times with its adequate oil resources, it could have used a flexible approach by taking full use of its advantage of oil, pay attention to balance the special relationship between Saudi Arabia and the United States, and ensure that the United States could tolerant the oil problem, so as to achieve their own interests of oil. In terms of time, is it possible for the Aramco to promote Saudi Arabia's request to the United States to mint gold coins as large tokens after World War II?

There were two sizes of gold discs minted by the United States for Saudi Arabia.

1. Large Gold Discs

Four-pound gold disc (Figure 1).

Fig. 1 Obverse inscription: U.S. MINT. PHILADELPHIA-U.S.A. The center of the discs is a bald eagle designed by Charles Thomson (1729-1824), representing the capable and intelligent elite, surrounded by words "United States Mint - Philadelphia - USA". The eagle centered in the inner tooth-edge circle of the obverse features the leftward face, spreading wings, and talons grasping an olive leaf (representing peace) on the left and a trapped arrow (representing the pledge of strength) on the right, with 13 horizontal stripes on its chest, representing the 13 states that joined the United States in 1777.

|

Figure 1

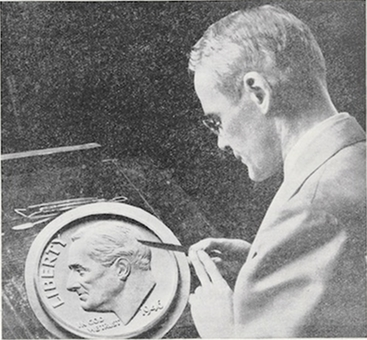

Figure 2 shows John Sinnock, who designed the Roosevelt dime and the Franklin half dollar. Sinock was the chief engraver of the Philadelphia Mint (1925-1947). I think he designed the eagle on the obverse based on the badge used on the coins by U.S. mint, and then he modified it and added inscriptions. The reverse has the inscriptions of the weight and purity in line with the official standard of British gold bullion. |

Figure 2 John R. Sinnock

The dime and half dollar were designed and engraved by John R. Sinnock, as well as other commemorative medals. As for this eagle badge, it has a modification on the original totem. Although Sinnock did not sign on it as the dime (JS) or half dollar (JRS), I presume he did not dare to exceed the rules to engrave his name as the he just modified the work according to the original badge.The reverse features a rectangular pattern with three lines of words [GROSS WEIGHT-493.1 GRAINS. -- NET WEIGHT-452.008333 GR-FINENESS 9162/3]. Therefore, a gold disc contains 452.00gr. or 0.942 oz. of gold, with 91.6% in purity.

Note: 493.1gr = 31.95g. The entire gold disc weights slightly over 1 oz. [1 once = 28.35g]. In 1945, a total of 91,210 pieces of large gold discs were issued, but most have been melted down.

Note: The British gold coins weigh 5 pounds, 2 pounds, 1 pound (Sovereign) and 1/2 pound. There is no 4-pound coin, which is unique. It is possible that the 4-pound coin is in line with the international popular system of one tael at that time.

|

Figure 3 One-pound gold disc

2. Small Gold Discs (Figure 3)

The obverse has the same design as the 4-pound gold disc; the reverse has three lines of inscription: CONTAINS - 0.2354 TROY OZS - FINE GOLD. Its denomination is 1 pound and the gold content is 7.32g.

Note: One troy oz is a British unite which is equal to 31.10g [31.10 x 0.2354 = 7.32g]. FINE GOLD means its purity is 999.9‰.

In 1947, the Philadelphia Mint struck 121,364 small discs, the vast majority of which were melted down. The design of small discs is similar to that of small British Sovereign gold coins, with the same amount as the 1-pound British Sovereign gold coin. These small discs were actually commonly used in Saudi Arabia and traded at a value of $12, or 40 Saudi riyals of silver.

The gold standard is a monetary system in which gold is the standard currency. A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold (that is, the gold content of currency); when different countries use the gold standard system, the exchange rate is decided by the gold parity of their respective currency gold content. The gold standard system became prevalent in the mid-19th century. In history, there have been three forms of the gold standard system, namely, gold exchange standard, gold bullion standard, and gold and fiat money standard. Among them, the gold fiat standard is the most typical form, and the gold standard system refers to such a monetary system in a narrow sense.

The international monetary system centered on the U.S. dollar after the Second World War is actually a gold exchange standard system. The United States does not circulate gold coins and private individuals cannot own gold coins, but allow other countries to exchange for gold discs as mentioned above with U.S. dollar in the name of government. The above 4-pound and 1-pound gold discs are financial products of this era, when the dollar was the main reserve asset of other countries. However, the system also gradually began to shake due to the impact of the dollar crisis. When it came to August 1971, the U.S. government stopped the exchange for gold with U.S. dollar, and it devalued the dollar twice. The incomplete gold exchange standard system collapsed, and the gold bullion standard system and the gold exchange standard system basically disappeared in the 1970s.

III How to Distinguish the Real from the Fake?

The 4-pound gold disc is cast with 22K gold [92% color, (22/24)] gold, and the 1-pound is equivalent to one sovereign of the United Kingdom. The gold disc is of brilliant color, excellent purity, warm feeling, and beautiful shape, being popular among the people. Yet, counterfeiting is rampant. For instance, Swiss and Lebanese counterfeiters began making similar gold discs with lower gold content.

Most of these gold discs are no longer in existence, as a large number of them were boxed up and shipped to Mumbai, India, sold for $70 per ounce, twice the official U.S. price. Many other gold discs were melted down, turned into gold bars and shipped to Macau for sale to private gold stores or the Chinese Central Mint for casting gold bullion. Afterwards, the Saudi Arabia government melted down many of the remaining gold discs, and reused them to produce its own gold coins. For example, in 1950, Saudi Arabia melted down most of the gold discs made in Philadelphia, USA, and started minting its own gold coins again. (Fig. 4)

|

Figure 4 (1950) Saudi Arabia One Guinea Gold Coin. Fineness: 0.9170.AGW: 0.2355oz .Weight: 7.9881g

Figure 5 Fake gold disc obverse

Today, only a small fraction of these unusual U.S. gold discs remain, which makes the demand greater than the supply. Collectors should be very careful and are advised to purchase certified examples. NGC has certified 205 large and 81 small discs, and PCGS has certified 41 large and 19 small discs. Judging from the number of examples appearing on auctions and certification capsules, small gold discs are rarer than large ones. It is assumed that the total number of existing discs is between 500 and 1,000 pieces. |

This is because their weights are exactly the same as those of other popular gold coins of the world at the time. This, coupled with the interesting historical background, beautiful design, gold splendor and high value gold disc (DISC), made these pieces a popular target for counterfeiters.

The genuine discs feature many bumps on the obverse, almost like tiny pebbles. Fakes also show this effect, but it appears weaker, without small bumps next to the letters. Especially in the circle of characters P.D., there is no or inconspicuous small raised bumps. Also, the genuine discs have the fine lines like a spider web between each characters of M-I-N-T. If there is no such feature, it may be a fake as Figure 5.

IV Conclusion

From the 1940s to the 1950s, the U.S. government played as the backstop and protector for companies to expanding their oil sources in the Middle East, while companies were the front speakers in increasing U.S. influence over countries or regions that needed oil.

The years of political and financial chaos in the world after World War II led to the rise of gold and oil prices and the fall of the U.S. dollar. The Saudi Aramco, an American international oil company, was established for exploring oil in the Middle East. The U.S. government has provided monetary and technical assistance to the Saudi Arabia government and set up worldwide financial procedures, such as the WTO and the Bretton Woods system, to maintain the world financial system.

In mid-February 1943, the managing directors of Mobil, Texaco and Casoc visited the U.S. Secretary of State in Washington, D.C. They requested financial assistance from the U.S. government in order to keep Britain out and ensure that they would remain U.S. companies after World War II. If the United States was willing to assist, in return the Saudi royal family will give the U.S. government certain opportunities and options to participate in the oil exploitation in Saudi Arabia. Beginning in 1944, the U.S. accelerated the pace of aid to Saudi Arabia under the Lend-Lease Act, and by the end of the war, U.S. direct or indirect aid to Saudi Arabia reached $90 million, 73% of which was gifted, making the U.S. the largest aid donor to Saudi Arabia.

Is it possible that the large 4-pound gold disc was minted in 1945 by the U.S. government for financial assistance?

Note: According to the record from 1949, the United States had gold reserves of 24.6 billion U.S. dollars, accounting for more than 70% of the total gold reserves of the entire capitalist world at that time.

In 1944, Socal changed its name to Arabian American Oil Company or Aramco for short. According to Boosel's article in the ANA journal The Numismatist published in July 1959, the contract between Saudi Aramco and the Saudi Arabia government required that Saudi Aramco pay an annual franchising fee of $3 million in gold to the Saudi Arabia government. Although payments in U.S. dollars were accepted throughout World War II, at the end of the war, the Saudi Arabia government insisted that payments by gold should be restored. Was it possible to use gold discs instead for hedging purposes? Considering that British gold coins were seldom seen in circulation in the market at this time, Aramco may have signed a contract with the U.S. Treasury Department to mint gold discs, which seems logical. The Philadelphia Mint produced the 1947 small discs that were identical to the gold British sovereign, and both gold coin and gold disc contain 0.2354 ounces of gold, with a purity or fineness of 0.9167, which underscores the fact that these gold discs were a replacement for the main 1-pound British gold coin.

According to the author's estimation, if so, it is a coincidence in terms of the timing of the 4-pound large American disc. For example, the time of the high price of gold after World War II, the restrictions of the Bretton Woods Agreement in 1944, and the issuance of large discs in 1945 are coincident.

Note: Though it is named the 4-pound gold disc for convenient circulation in the world, it is also known as one-tael gold disc as it is nearly one tael.

According to the J.P. Koning's article Why the US Mint once issued gold discs to Saudi Arabia published in November 26, 2018, a reference from the Federal Reserve Economic Research Documentation System (FRASER) indicates, "... in October 1947, the US Mint received a third order from the Saudi Arabia government. But the Saudi Arabia government eventually canceled this third order based on a better offer. In December of that year, U.S. officials told the Saudi Arabia government that the Treasury was willing to auction off the old British gold sovereigns held in its official reserves. For the Saudi Arabia government, this actual auction offer was too good to give up, so they canceled the third request to cast gold discs, and purchased the gold pounds auctioned by the United States ..." It can be seen that the Saudi Arabia government had the possibility to make the first (1945 large gold disc) and the second (1947 small gold disc) orders.

In the Second World War, Saudi Arabia itself, like most countries in the Middle East, did not have its own monetary system, that is, it did not produce its own coins. For smaller transactions, the Saudi people relied mainly on foreign silver coins, including, for example, the Maria Theresa dollar, a coin minted in Austria, which was the most commonly used at the time. Second is the Indian rupee. For bigger transactions the Saudis used the British gold pound. However, around the First and Second World Wars, the British economy was weak and gold was in shortage. The Britain no longer minted British gold pounds, which would inevitably lead to a shortage of British gold pounds. Against this background, Saudi officials would go out of their way to provide the country with a viable alternative to gold for circulation within its borders.

Therefore, it is entirely reasonable for the Saudi Arabian government to seek help from the U.S. Treasury Department. At the time, the U.S. Treasury was the largest owner of gold in the world, and the U.S. Mint could mint coins. The Saudi Arabian government had originally requested the British government to supply the original dies for the British gold pounds to the U.S. Mint in Philadelphia for minting, but British officials refused to grant the U.S. Mint the original dies for the sovereign gold coins. The Philadelphia Mint offered a good second-best choice for the Saudi Arabia government in the form of simple, attractive gold discs of a size and weight similar to the British gold coin series. In addition to their widely-accepted purity, weight, and markings, they were also be part of a mainstream worldwide currency system.